12 Call Center Metrics You Should Be Using to Improve CX in 2025

Call center metrics are the most important performance indicators that monitor how effectively your call center is running. This includes anything...

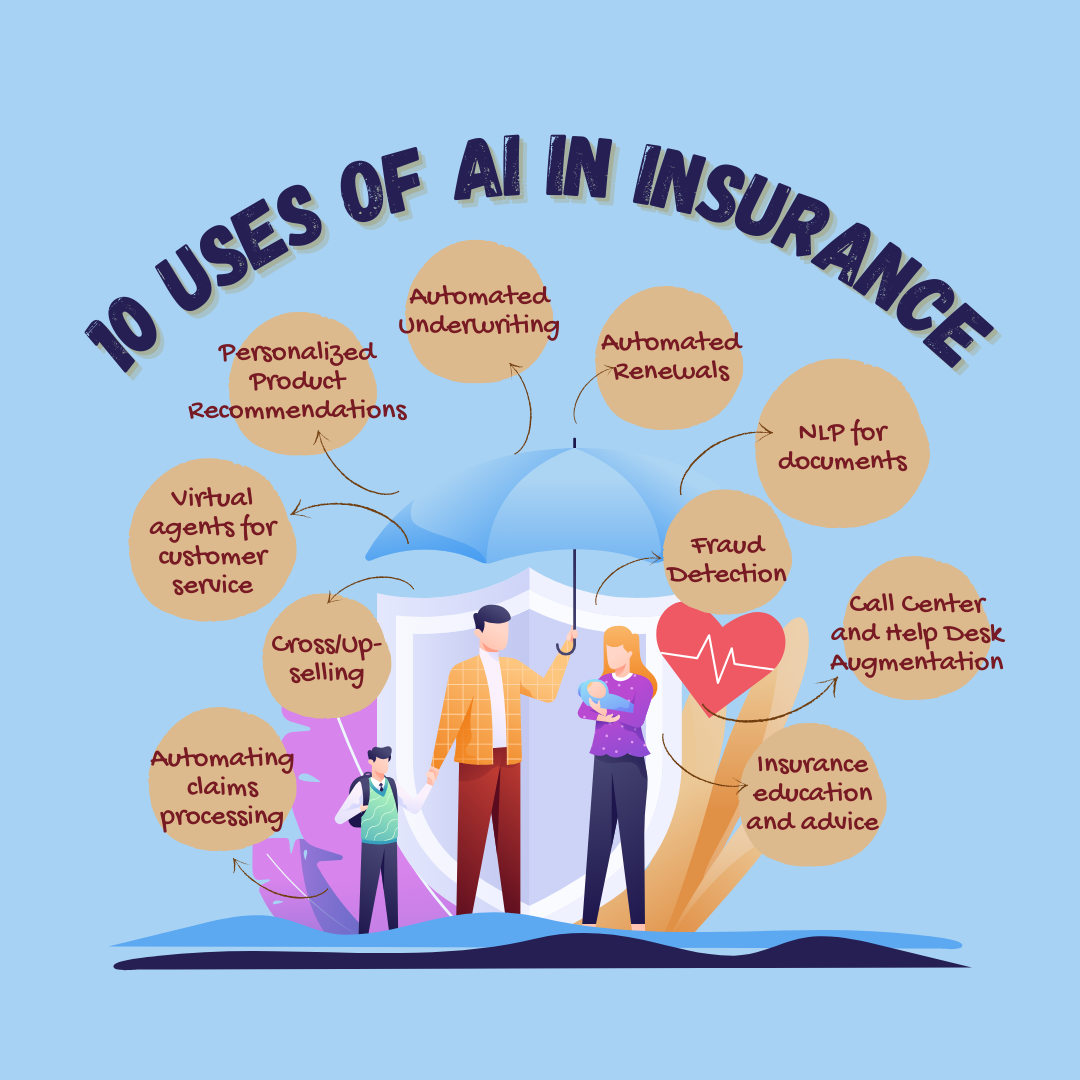

The insurance industry is rapidly adopting conversational artificial intelligence (AI) tools like chatbots and virtual agents to improve customer service, increase efficiency, and reduce costs. Here are 10 key use cases where insurers can benefit from conversational AI:

One of the biggest potential uses of conversational AI in insurance is automating parts of the claims process. Virtual agents can be programmed to ask claimants basic questions, gather required documents and forms, and validate information provided. This speeds up initial claims assessment and reduces manual processing.

According to Accenture, automated claims handling with AI can help insurers reduce claim settlement times by 74%. This greatly improves customer satisfaction and frees up staff to focus on more complex claims.

Many insurers now use intelligent virtual agents (IVA) to handle common customer service queries. These AI systems can understand natural language, answer questions about policies or claims, recommend suitable products, and perform various other assistance tasks.

One study found 62% of customers prefer customer service bots for quick query resolution compared to waiting on the phone. Providing fast, 24/7 support via virtual assistants improves the customer experience.

Based on a customer's profile and dialog during a conversation, AI can suggest the most appropriate insurance products and coverage limits. This provides a customized shopping experience.

In a recent study, 99% of respondents said AI-powered bots boosted conversion rates. More than half said their conversion rate was lifted by at least 10%. AI personalization helps turn more prospects into customers.

By analyzing customer data and conversation content, conversational AI allows insurers to identify upsell and cross-sell opportunities. Bots can proactively recommend add-ons or complementary products that align with an individual's needs.

For example, after filing a home insurance claim a customer may be open to buying flood insurance. An AI assistant could prompt them about policies available. This automates the upsell process at opportune moments.

AI has become invaluable for insurers in identifying fraudulent activity. IVAs equipped with natural language and speech recognition can detect linguistic indicators of fraud in written or spoken conversations.

According to McKinsey & Company, one European insurance carrier used an AI-based detection system to improve fraud prevention by 18%. AI makes fraud easier to catch during interactions with customers.

Conversational AI streamlines the insurance application and underwriting processes. Virtual agents can simulate a human-like dialog to gather applicant information, while machine learning assesses risks and determines suitability.

Swiss Re estimates that automated underwriting can reduce the time needed from weeks to hours while still maintaining underwriting quality. Conversational AI dramatically speeds up applicant onboarding.

Renewals are a major part of customer retention. IVAs can proactively contact policyholders to renew, summarize changes in coverage or cost, collect updated personal details, and process renewals.

Insurers have to process immense numbers of documents like claims forms, medical reports, invoices and more. Conversational AI can extract key unstructured data from documents and classify them based on natural language understanding.

This reduces time-consuming manual reviews and data entry. It also speeds up regulatory compliance through better document management.

IVAs are increasingly used in insurance call centers to automate common queries and provide 24/7 self-service. Handing these conversations off to virtual agents reduces call volumes and frees human agents to deal with complex issues.

According to IBM, AI virtual agents can handle up to 80% of repetitive customer support calls. This significantly lowers costs and wait times.

Many customers don't fully understand insurance and could use better advice. Conversational AI can deliver personalized education, explain insurance concepts, recommend appropriate coverage, and provide step-by-step guidance tailored to the user.

As the examples above demonstrate, artificial intelligence has wide-ranging applications throughout the insurance sector that can improve operations and customer experience. Adoption of conversational interfaces like IVAs is accelerating and for good reason. The technology will continue disrupting how insurers interact with customers, underwrite policies, process claims and renewals, detect risks, and educate users.

With more powerful natural language processing and deep learning techniques, the capabilities of AI virtual assistants and chatbots will keep growing. The insurance industry is poised to continue expanding its use of conversational AI to drive efficiency, personalization and innovation into the future.

There's another form of AI that will have a major impact on the insurance industry in coming years. According to Gartner, 80% of customer service and support organizations will use generative AI to improve agent productivity and customer experience. To see what that might look like, check out these examples illustrating how companies are using generative AI today.

Call center metrics are the most important performance indicators that monitor how effectively your call center is running. This includes anything...

Businesses across industries have changed or evolved over the decades, but one thing that has remained the same is that their growth is pretty much...

Customers have several major expectations from modern businesses, but none is as challenging as them reading your mind to anticipate support you...